By The Texas Automobile Dealers Association

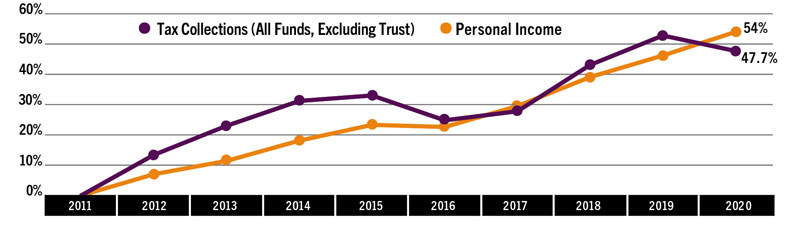

State Tax Collections and Personal Income

FISCAL 2011-2020

Cumulative Growth Rates

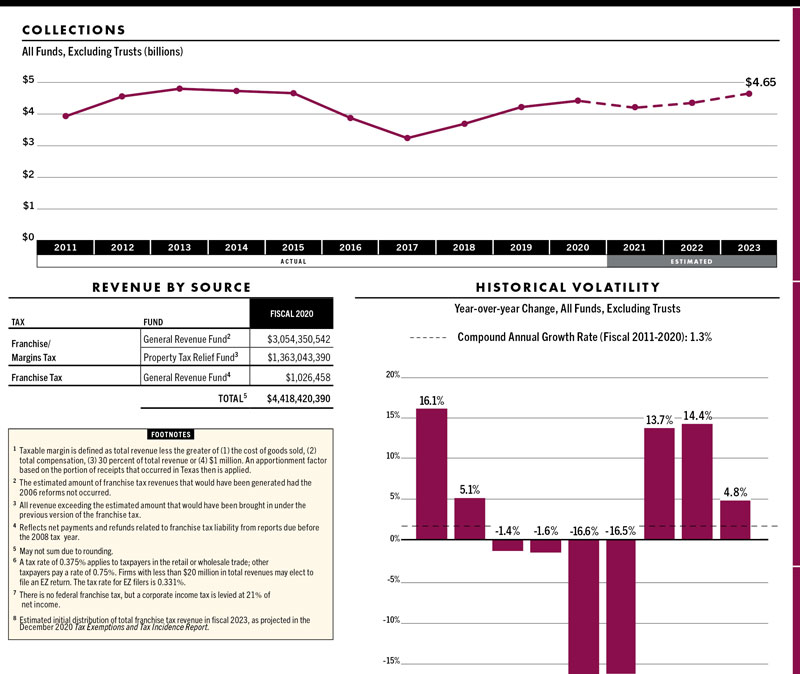

State tax collections saw higher cumulative growth rates than Texas personal income from fiscal 2011 through 2014. Collections declined in 2016 due to franchise tax cuts and a slowdown in the oil and gas industries. Tax collections rebounded in 2018 due mostly to increased remittances from taxpayers in the oil and gas industries and rose moderately in 2019 as taxable spending in these industries plateaued.

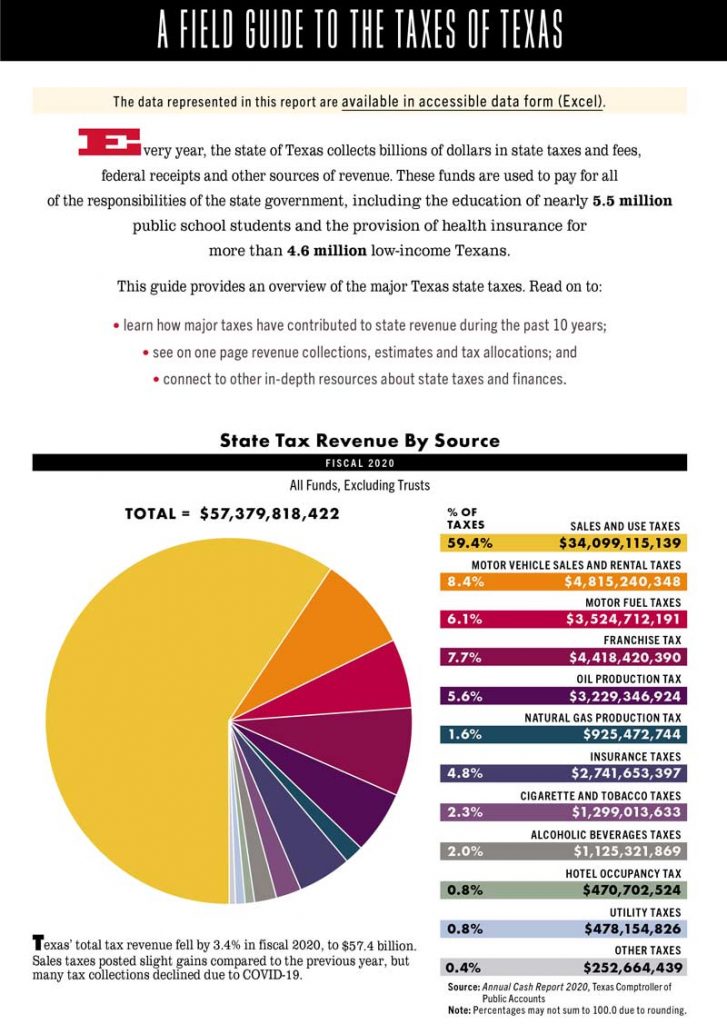

Some tax categories saw record year-over-year declines in fiscal 2020 collections due to the COVID-19 pandemic and a collapse in oil prices. The decrease in total tax collections would be even more substantial if not for sales tax revenue, which was buoyed by strong online sales and spending on building materials, home furnishings and sporting goods.

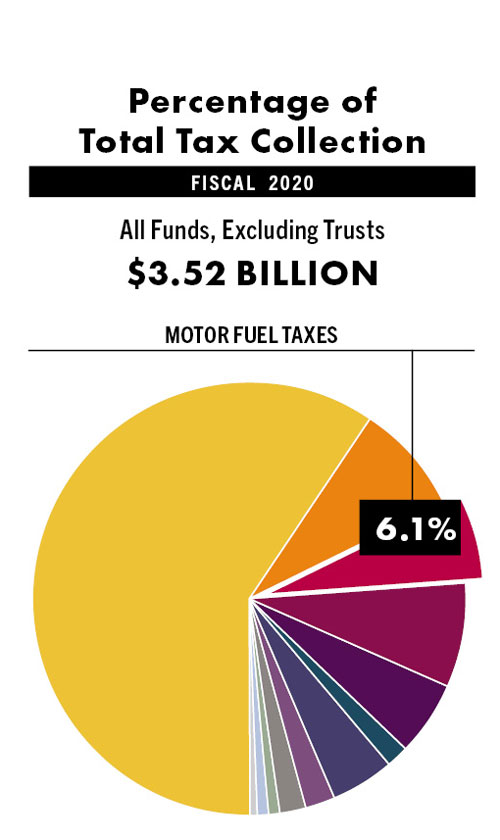

Where Does Texas’ Tax Revenue Come From?

- Texas imposes a 6.25% sales and use tax on sales, leases and rentals of goods as well as on taxable services such as telecommunications and amusement services.

- Texas taxes motor vehicle sales at a rate of 6.25% of the sales price minus any trade-in allowance. Motor vehicle rentals are taxed at 6.25% or 10% of gross receipts depending on the length of the rental contract.

- Texas’ motor fuel tax rates can vary depending on the type of fuel; the two most common, gasoline and diesel, both are taxed at 20 cents per gallon.

- The state’s franchise tax is imposed on certain kinds of businesses operating in Texas such as corporations, banks, limited liability corporations and partnerships. Of the millions of businesses across the state, only about 140,000 filers usually owe any franchise tax.

- Texas’ severance taxes are imposed on entities that extract nonrenewable natural resources such as oil or natural gas. They are levied at rates of 4.6% of market value for oil and condensate and 7.5% of market value for natural gas. Revenues from these taxes are highly variable depending on market conditions.

- The state’s insurance taxes include a number of premium taxes levied at rates ranging from 0.5% to 4.85% of gross premiums, as well as various maintenance taxes.

- Texas’ “sin” taxes are levied on tobacco and alcoholic beverage products. The largest taxes in revenue terms are the cigarette tax, levied at $1.41 per pack of 20, and mixed beverage taxes, imposed on consumers at 8.25% of the sales price and on business permit holders at 6.7% of gross receipts.

Where Does Texas’ Tax Revenue Go?

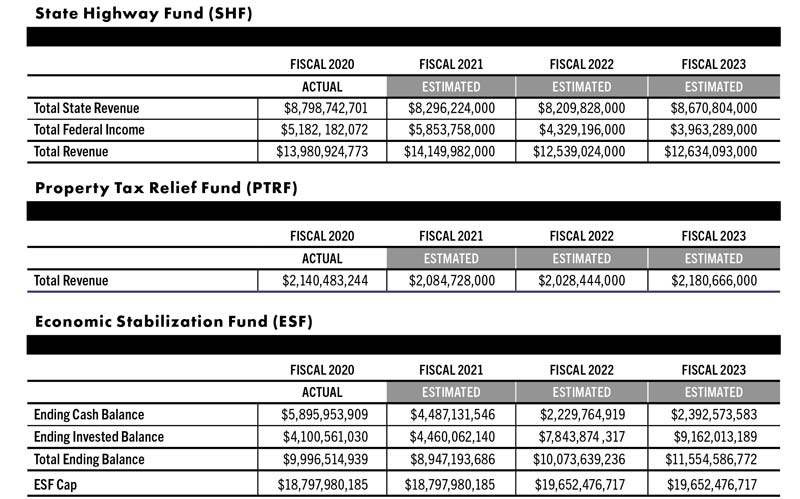

For accounting and budgeting purposes, state revenue is deposited or transferred into various funds, with most going into the General Revenue Fund (GR) for appropriation by the Legislature. Some tax revenue, however, is deposited directly or transferred into special funds for specific purposes. Three of the state’s most prominent special revenue funds are the State Highway Fund (SHF), the Property Tax Relief Fund (PTRF) and the Economic Stabilization Fund (ESF).

The SHF is used for the construction, maintenance and policing of public roads. Historically, the primary revenues for this fund have been federal receipts, 75% of motor fuel tax net collections, most motor vehicle registration fees and, since fiscal 2015, one-half of 75% of oil production and natural gas production tax revenues exceeding fiscal 1987 collections in any fiscal year. A constitutional amendment approved by Texas voters in 2015 allocated the first $2.5 billion of state sales tax collections in excess of $28 billion in a fiscal year to the SHF. Starting in fiscal 2020, 35% of motor vehicle sales and rental taxes collections in excess of $5 billion are transferred into the SHF. In the 2022-23 biennium, the Comptroller’s office estimates the SHF will receive $25.2 billion from all sources.

The PTRF is used along with GR and other funds to finance the state’s K-12 public education system. The major revenue sources for this fund include the amount of franchise tax collections generated by its restructuring in fiscal 2008, and revenue generated from the $1.00 increase in the cigarette tax rate implemented in fiscal 2007. Over the 2022-23 biennium, the Comptroller’s office estimates the PTRF will receive $4.2 billion from all sources.

The ESF, also known as the Rainy Day Fund, receives one-half of 75% of oil production and natural gas production tax revenues in any fiscal year that exceeds fiscal 1987 collections, and one-half of any unencumbered GR surplus remaining at the end of each biennium. By the end of fiscal 2023, the total ending balance of the ESF is projected to reach $11.6 billion, assuming no withdrawals are made during the 2022-23 biennium. This balance would represent 58.8% of the cap, as set by the Texas Constitution.

Want More Details?

The Comptroller’s office publishes many reports that assist state government planning and decision-making and account for state spending to the taxpayers of Texas. This guide highlights some of the current data from several of these reports, and provides links to find more in-depth or updated data. The full reports can be found at comptroller.texas.gov/transparency/reports.

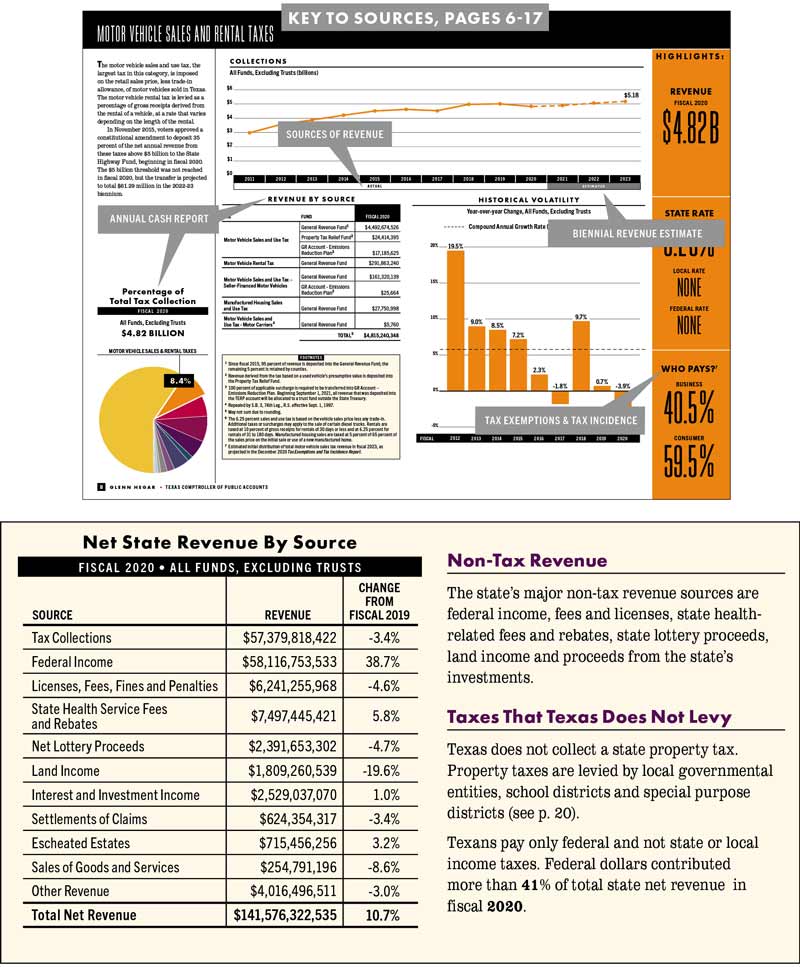

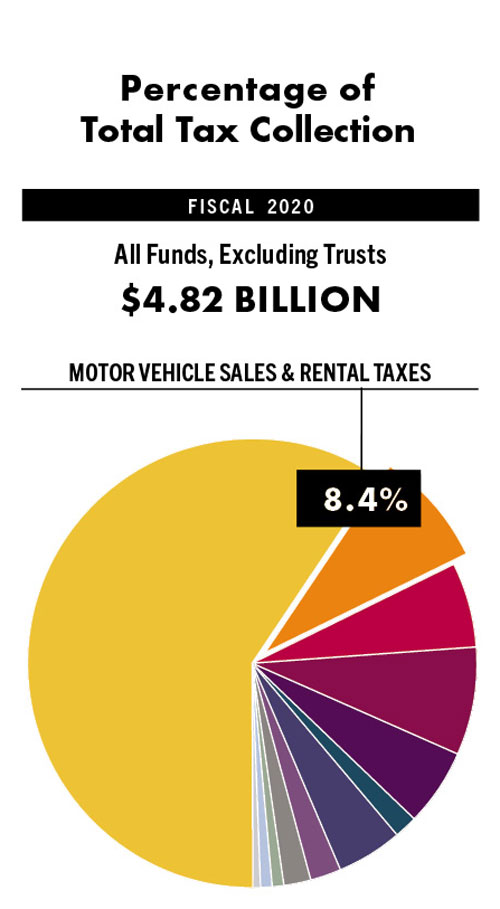

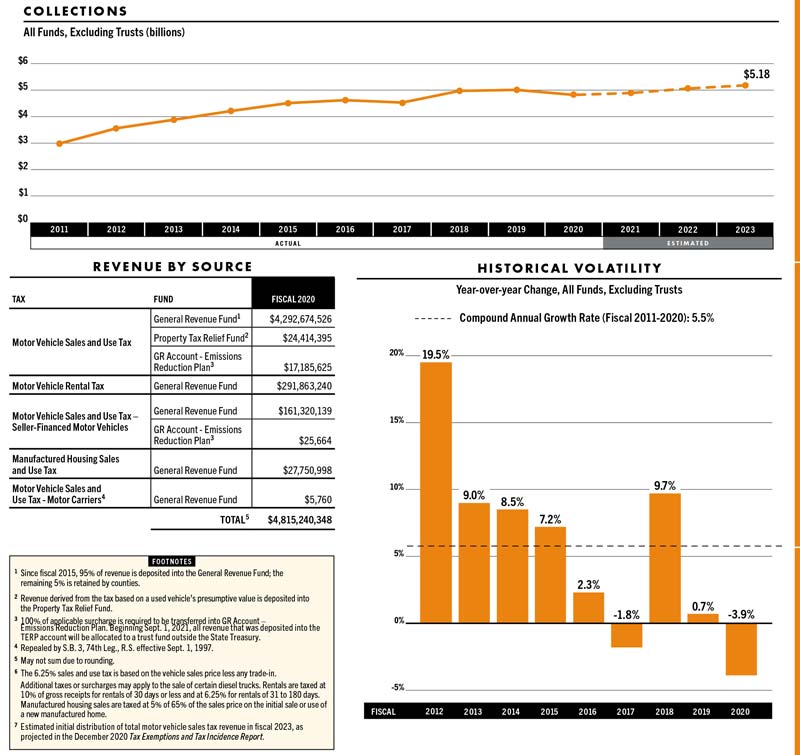

MOTOR VEHICLE SALES AND RENTAL TAXES

ENACTED 1941

The motor vehicle sales and use tax, the largest tax in this category, is imposed on the retail sales price, less trade-in allowance, of motor vehicles sold in Texas. The motor vehicle rental tax is levied as a percentage of gross receipts derived from the rental of a vehicle, at a rate that varies depending on the length of the rental.

In November 2015, voters approved a constitutional amendment to deposit 35% of the net annual revenue from these taxes above $5 billion to the State Highway Fund, beginning in fiscal 2020. The $5 billion threshold was not reached in fiscal 2020, but the transfer is projected to total $61.29 million in the 2022-23 biennium.

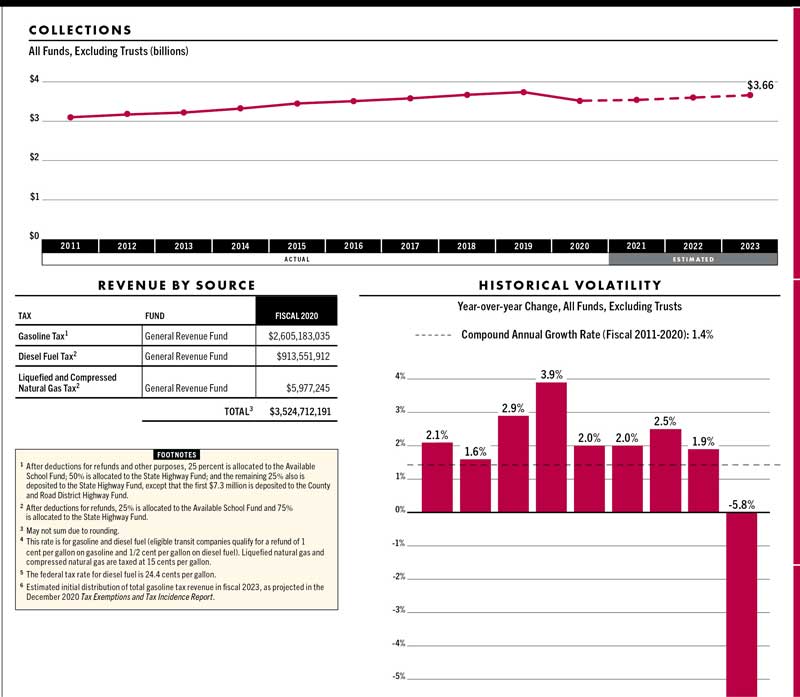

MOTOR FUEL TAXES

ENACTED 1923

Motor fuel taxes are the state’s consumption taxes on gasoline, diesel fuel and liquefied and compressed natural gas. In general, these taxes are charged on each gallon of fuel sold in Texas used to propel vehicles on Texas’ public roads.

The rates for the gasoline and diesel fuel taxes last changed in 1991, when they were both increased from 15-20 cents per gallon.

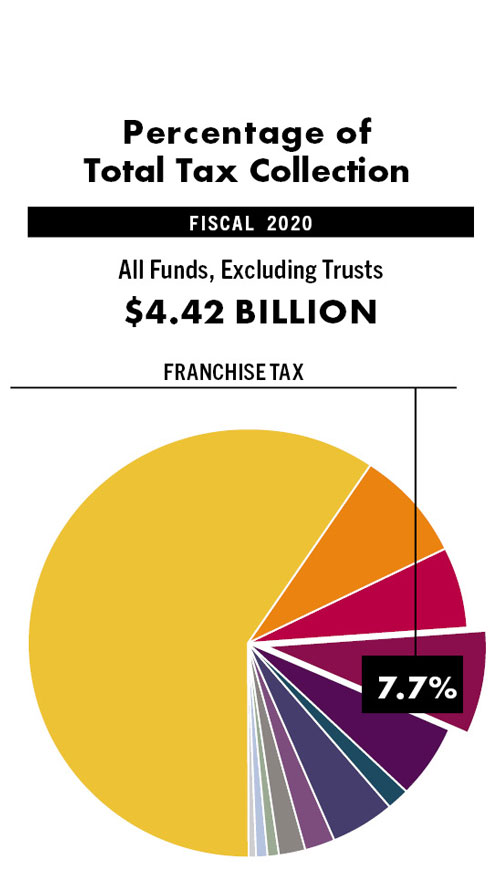

FRANCHISE TAXE

ENACTED 1907

The franchise or “margins” tax is the current version of one of the state’s oldest taxes, levied for the privilege of doing business in Texas. The tax due is based on an entity’s apportioned taxable margin.1

In 2006, the Legislature made significant changes to the tax, including transitioning to the taxable margin as the sole base component and expanding the tax to limited partnerships, business trusts and other legal entities.

In 2015, the Legislature voted to reduce franchise tax rates by 25%.